Kirkland Lake Gold Ltd. announced overnight that the Company has revised and increased its consolidated three-year production guidance and improved its unit-cost guidance for 2019. The Company also announced today Mineral Reserve and Mineral Resource estimates for December 31, 2018, which include growth in Mineral Reserve ounces and average grades at both Fosterville and Macassa, as well as on a consolidated basis.

Key Highlights of the Production Guidance and Mineral Reserve Estimates Include:

Potential for a million ounces in 2019 with three-year production guidance increased to 920,000 – 1,000,000 ounces for this year, 930,000 – 1,010,000 ounces for 2020 and 995,000 – 1,055,000 for 2021;Fosterville three-year guidance revised to 550,000 – 610,000 ounces for 2019 and 2020, with production guidance for 2021 remaining unchanged at 570,000 – 610,000 ounces, respectively; Production to resume at Holloway, with 20,000 ounces expected in 2019 increasing to 50,000 ounces by 2021

Consolidated unit-cost guidance for 2019 improved, with operating cash costs per ounce guidance revised to $300 – $320 from $360 – $380 previously, with AISC per ounce sold improved to $520 – $560 compared to previous guidance of $630 – $680; Fosterville’s 2019 operating costs per ounce sold guidance improved to $170 – $190 from $200 – $220 previously

Consolidated Mineral Reserves increase 1.1 million ounces or 24% to 5,750,000 ounces @ 15.8 grams per tonne (“g/t”) at December 31, 2018 (total additions of 1,860,000 ounces before depletion of 750,000 ounces)

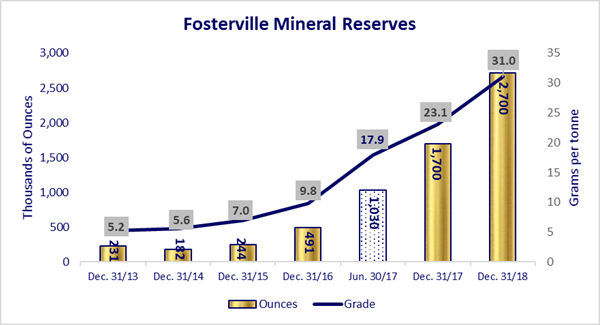

Fosterville Mineral Reserves increase 1,020,000 ounces or 60% to 2,720,000 ounces @ 31.0 g/t at December 31, 2018 from 1,700,000 ounces @ 23.1 g/t (total additions in 2018 of 1,386,000 ounces before depletion of 366,000 ounces); Growth in Mineral Reserves at December 31, 2018 reflects 34% increase in average grade and 19% growth in total tonnes, to 2,720,000 tonnes from 2,290,000 tonnes at December 31, 2017

Mineral Reserves at Macassa increase 11% to 2,250,000 ounces @ 21.9 g/t from 2,030,000 ounces @ 21.0 g/t at December 31, 2017 (total additions of 464,000 ounces before depletion of 244,000 ounces)

Tony Makuch, President and Chief Executive Officer of Kirkland Lake Gold, commented: “Since November 2016, Fosterville has been transformed into one of the world’s highest-grade, most profitable gold mines, which has greatly benefited Kirkland Lake Gold and its shareholders. The completion of Fosterville’s December 31, 2018 Mineral Reserve and Mineral Resource estimates, with the related revisions to its life of mine plan and production profile, have taken that transformation to an even higher level, with the potential for much more to come. Largely driven by the 34% increase in the Fosterville Mineral Reserve grade, we are now on track to achieve significantly higher levels of production at Fosterville in 2019 than previously expected and could reach one million ounces of annual gold production as early as this year. Just as encouraging as the growth in ounces, is the fact that with a higher average grade at Fosterville, as well as at Macassa, our Mineral Reserve ounces are more valuable, which means improved unit costs and increased cash flow per ounce going forward based on current gold prices.

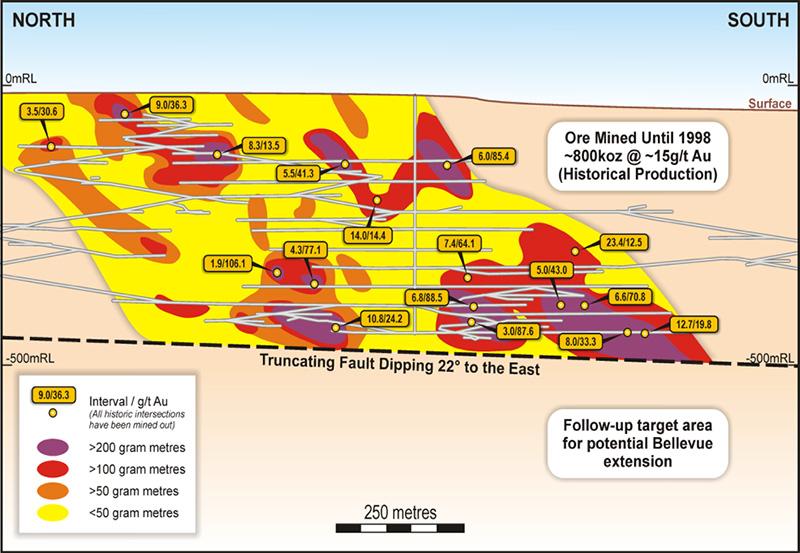

“Looking at our Mineral Reserves in more detail, the 24% increase in consolidated Mineral Reserves is a testament to the effectiveness of the infill drilling programs at Fosterville and Macassa. At Fosterville, there is considerable potential for further Mineral Reserve growth at a number of areas, including the Swan Zone, other parts of the Lower Phoenix system, Harrier and a number of other targets, like Robbin’s Hill, where early exploration results demonstrate the potential for attractive economic orebodies. Turning to Macassa, we converted close to half a million ounces of Mineral Resources to Mineral Reserves in 2018 and have a number of high-potential areas in and around the South Mine Complex (“SMC”) that we are targeting for future growth in Mineral Reserves and Mineral Resources.”