Rare Earth Element discovery at the Mount Squires Project

Konrad Forrest

Caspin Resources Limited (ASX: CPN) has announced a significant discovery of Rare Earth Element (REE) mineralization at the Mount Squires Project in Western Australia. The discovery marks the first significant REE mineralization in the West Musgrave Province, and the finding was made despite the tiny scale of the assay program.

Caspin’s CEO, Greg Miles, was enthusiastic about the discovery, saying, “This is a sensational discovery given the tiny scale of the assay program.” He added that while the company had long recognized the potential for rare earth mineralization at Mount Squires, the focus had been on nickel, copper, and gold until now.

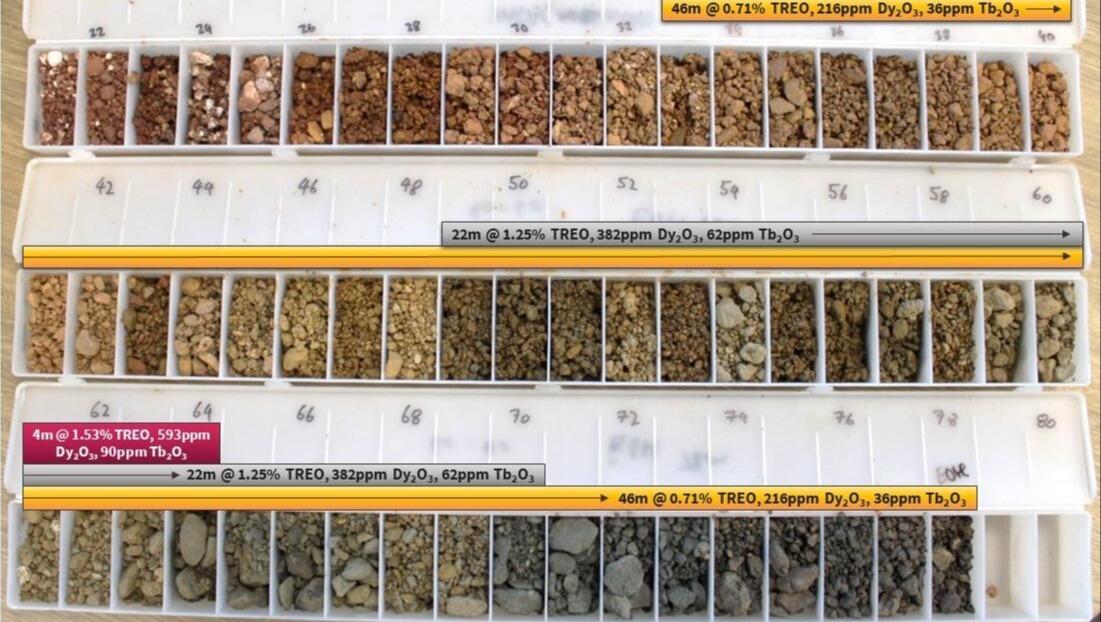

The recent-assaying of Duchess aircore holes has identified significant shallow REE mineralization. The drill holes include a 46m length with 0.71% total rare earth oxide (TREO) from 32m, a 19m length with 0.41% TREO from the surface, a 7m length with 0.32% TREO from the surface, and a 10m length with 0.14% TREO from 36m.

The assays indicate a significant proportion of high-value light and heavy rare earth elements in TREO. Notably, the NdPr:TREO averages 19%, the HREE:TREO averages 28%, and the Dy2O3:TREO averages 2.9%. There is also the potential for credits from accessory base metals.

The rhyolite volcanic host rock is strongly enriched with REE, and there is likely secondary enrichment through weathering and hydrothermal processes. The discovery highlights the potential to identify significant deposits of REE elsewhere in the project, and a geological review is underway.

Miles also noted that the discovery highlights the potential for REE mineralization throughout the project, with potentially more targets beyond the Duchess Prospect. An upcoming RC drill program will test extensions and obtain samples for metallurgical test work.

Caspin Resources Limited’s discovery of significant REE mineralization at the Mount Squires Project is an exciting development for the company and the industry. As exploration continues, there is the potential for further discoveries and the identification of significant deposits of REE.