St Barbara Solid Production Results

Tajha Pritchard

St Barbara Provides Production Update for FY23 and Q4 FY23

Following the recent completion of the sale of its Leonora assets to Genesis Minerals, St Barbara has released a production update for the June 2023 quarter (Q4 FY23) and the entire 2023 financial year (FY23).

St Barbara has reported a total group gold production of 260,368 ounces for FY23, achieving the upper end of its production guidance for the year.

During Q4 FY23, the company recorded a total group gold production of 77,125 ounces, showing a significant increase compared to the 58,567 ounces produced in the previous quarter (March 2023).

St Barbara also reported a substantial increase in cash balance during Q4 FY23, with $294 million on hand, representing a $234 million increase from the March quarter.

At the Atlantic operations, St Barbara achieved a gold production of 11,081 ounces in Q4 FY23 and 43,998 ounces for FY23, falling within the production guidance range of 40,000–50,000 ounces.

The Simberi operations contributed 25,189 ounces to the Q4 FY23 production and 78,320 ounces to the overall FY23 production, meeting the production guidance of 70,000–80,000 ounces.

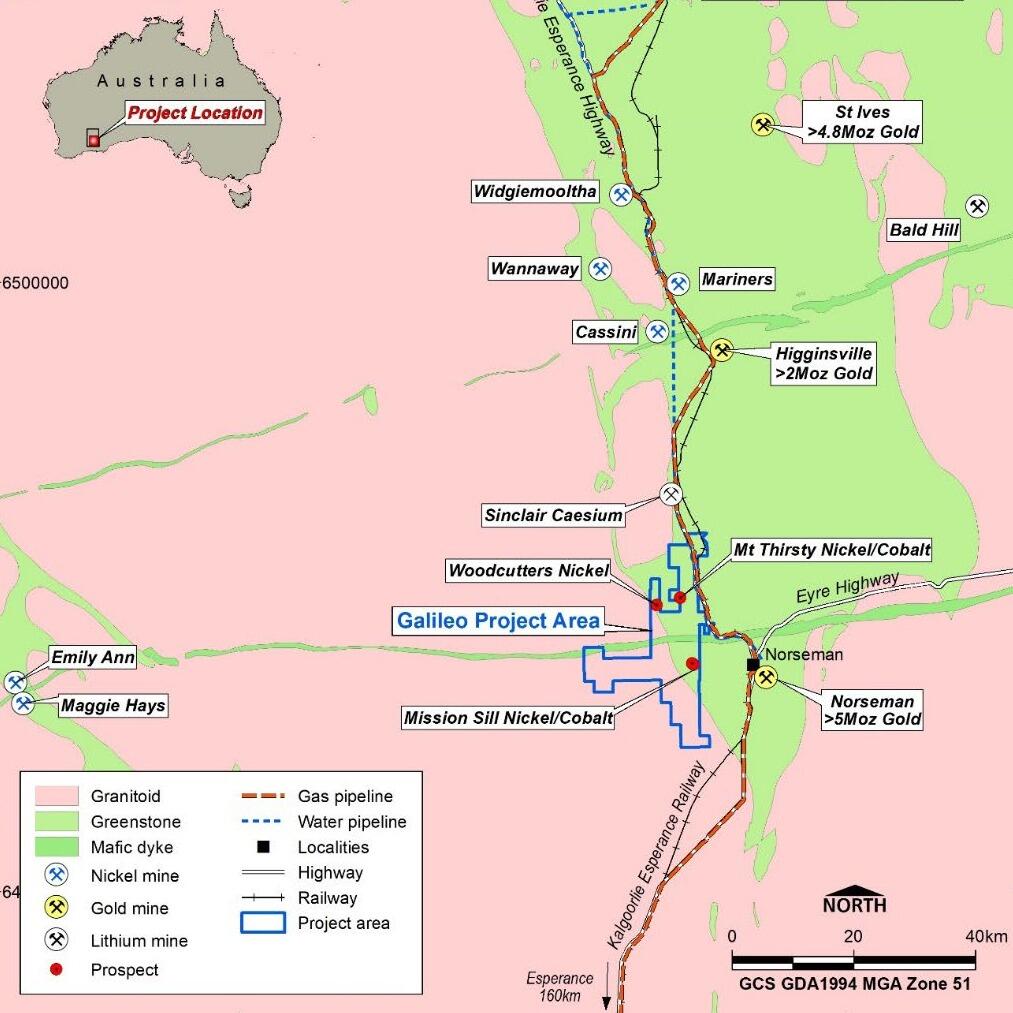

Regarding the Leonora assets, St Barbara reported a gold production of 138,050 ounces for FY23, within the production guidance range of 130,000–135,000 ounces. In Q4 FY23, 40,855 ounces were produced from the Leonora assets.

St Barbara highlighted the successful production from higher-grade stopes at the Gwalia underground mine, which had been delayed from the previous quarter. The improved grades from these stopes, along with better grade material from development drives, resulted in a quarterly mill throughput of 243 kilotons at an average grade of 5.45 grams per tonne.

Genesis Minerals' Managing Director, Raleigh Finlayson, expressed satisfaction with the transaction, stating that it has created a leading Australian gold house focused entirely on the Leonora assets. He emphasized that the next six months will involve a strategic review of the Gwalia mine to ensure its continued success as a prolific gold asset.

St Barbara is scheduled to release its June quarter report for FY23 on July 27, providing further insights into its performance during the period.